Corporate vs. Commercial Real Estate: Key Differences

In the world of real estate, your 'why' probably dictates your 'how.' If you are leasing or owning space to run a business, you are playing a different game than someone buying property for a financial return. To make confident decisions, you must first understand the divide between Corporate Real Estate and Commercial Real Estate.

In the real estate market, Corporate Real Estate (CRE) and Commercial Real Estate are often used interchangeably. In practice, they serve very different purposes, and confusing the two can lead to costly strategic mistakes.

What is real estate?

Real estate refers to land and the buildings or structures permanently attached to it, along with the legal rights associated with ownership or use. Real estate is generally categorized based on its intended use and economic function. The main types of real estate include:

Residential real estate: Properties intended for housing, such as single-family homes, condominiums, apartments, and multi-residential buildings.

Commercial real estate: Properties intended for business and commercial purposes, including office buildings, retail spaces, shopping centers, restaurants, hotels, and healthcare facilities.

Industrial real estate: Properties used for production, storage, and distribution, such as warehouses, logistics centers, manufacturing facilities, and data centers.

Land: Undeveloped land, agricultural parcels, and sites intended for future development.

Within these categories, real estate may serve either an investment purpose or an operational purpose, a distinction that defines the difference between Commercial and Corporate Real Estate.

Corporate Real Estate (CRE)

A company or a corporation may own or lease a variety of real estate assets with the intent to support its business operations. This includes properties a company owns or leases to operate, grow, or reposition its activities, such as offices, warehouses, data centers, and retail locations. The portfolio of these real estate assets is called Corporate Real Estate (CRE). When a company is responsible for a real estate portfolio, it requires meticulous management. There are three core functions in corporate real estate:

Portfolio Management: The main objective of CRE is primarily to optimize the portfolio and secondarily to reduce its cost. It starts with setting up robust data reporting systems for better inventory assessment, then ensuring that the size, location, and type of space support long-term business needs.

Transaction Management: Corporate real estate requirements change over time. Based on business needs, decisions are made regarding site selection, lease negotiation, and property acquisition. These must be properly managed and executed by transaction management teams with the support of brokers and legal advisors.

Facility Management: This team ensures the organization, functionality, and safety of each corporate real estate asset. Multiple groups are involved: workplace and space planning to design spaces that support how people work; the project management group that plans and delivers renovations, fit-outs, relocations, and capital projects; facility operations ensuring building performance, safety, and business continuity; and the financial group that controls costs and manages risk.

The objective of corporate real estate is to enable performance, productivity, and organizational success. CRE decisions are critical to the business and must be validated before any lease, contract, or financial commitment.

Commercial Real Estate

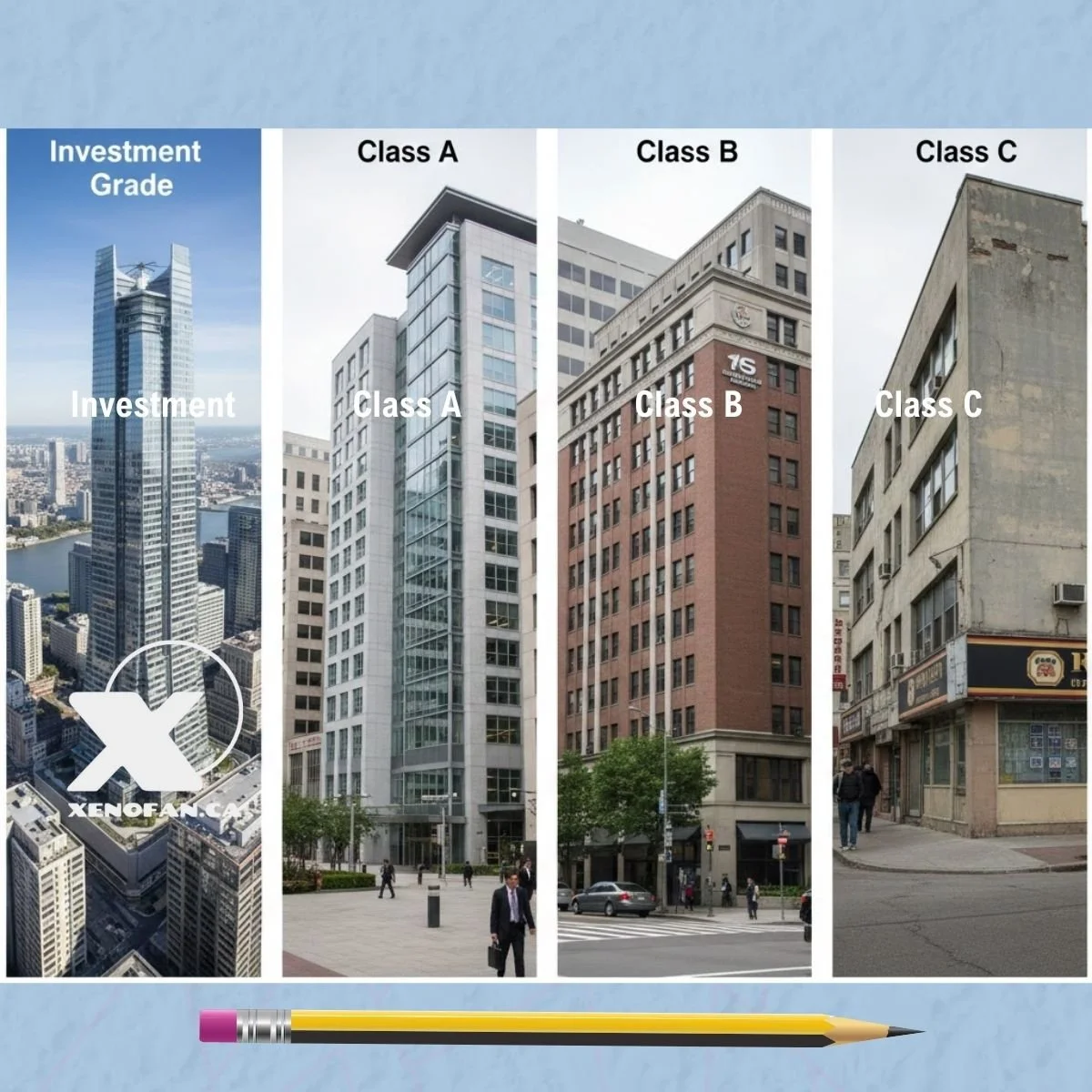

Commercial Real Estate is primarily investment-driven. There are various classes and categories of properties, such as Class A buildings and investor-grade buildings. Properties are acquired to generate stable income or capital appreciation, with decisions centered on financial performance.

Individual and institutional investors own commercial real estate for returns relative to risk and capital deployed. Even though industrial real estate can be owned for the same reason, it is a different asset class.

Investors enter the market to capture rental income and manage risk exposure, subsequently overseeing asset management, optimizing lease structures, and securing high-quality tenants. Their strategy concludes with a clear exit plan driven by asset valuation, market timing and other factors.

The bottom line

Commercial Real Estate optimizes financial returns.

Corporate Real Estate optimizes business operations and strategic alignment.

Applying an investment mindset to operational real estate, or vice versa, often results in underperforming assets, inefficient workplaces, or misaligned decisions. The right real estate strategy depends on why a space is owned or leased.

Supporting business objectives requires a fundamentally different approach than maximizing asset value. This is where experienced Corporate Real Estate professionals bring real value—by aligning real estate decisions with organizational strategy, performance, and long-term outcomes.

With Xenofan:

We help organizations make retail and office renovation decisions through expert planning, transparent communication, and strategic cost engineering—before any lease, budget, or contract commitment.

Once decided, we provide full-service project delivery to bring the vision to life.

Plan better. Decide faster. Make real estate decisions with confidence.